Understanding your shift report is crucial for tracking sales, tips, and cash drawer accuracy. Below, we’ll break down each section of the shift report to help you interpret its data effectively.

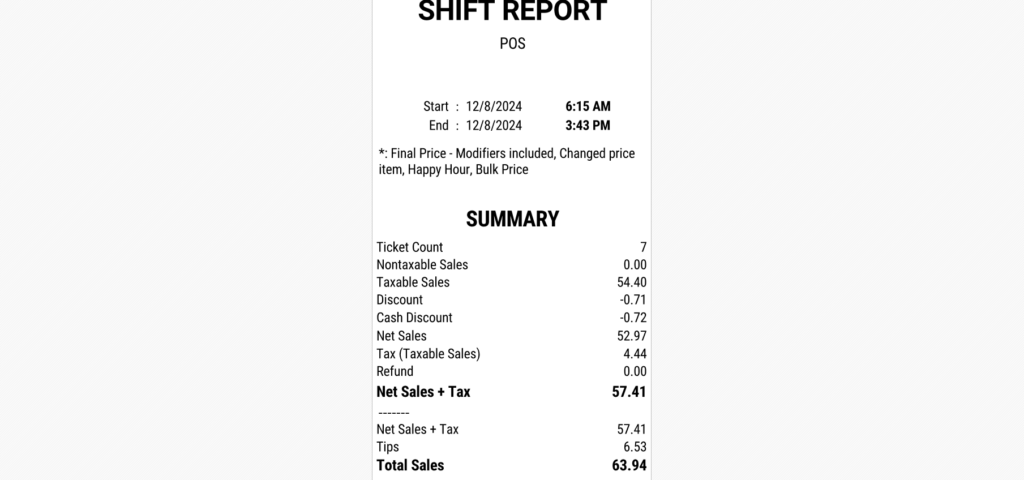

A.Summary

This section provides an overview of key sales and payment metrics for the shift.

Ticket Count

The total number of tickets (orders) processed during the shift.

Nontaxable Sales

Sales that are not subject to tax, certain non-taxable items.

Taxable Sales

The total sales amount that is subject to tax.

Discount

The total value of discounts applied during the shift.

Cash Discount

The total amount of discounts specifically for cash payments.

Net Sales

Original price of items (taxable & non-taxable)) after subtracting discounts.

Tax (Taxable Sales)

The total tax collected on taxable sales.

Refund

The amount refunded to customers during the shift.

Net Sales + Tax

The total of net sales and tax combined.

Tips

The total tips received during the shift.

Total Sales

The grand total of sales, including tips and taxes.

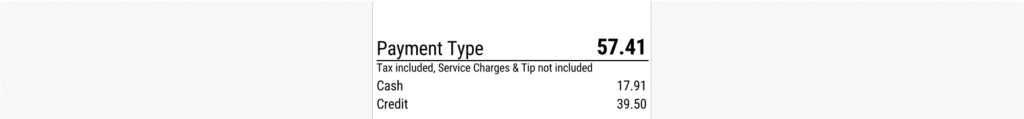

B. Payment Type

This section breaks down the sales by payment method.

Tax Included, Service Charges & Tip Not Included

Shows the sales amount for each payment type, with tax included but excluding tips and service charges. All payment methods are listed in detail.

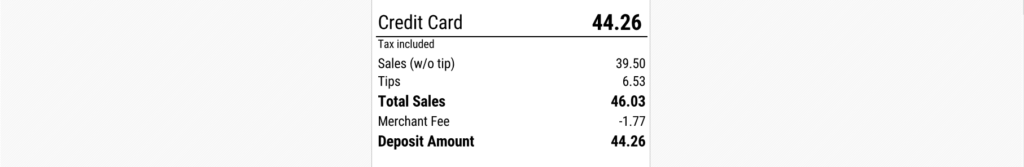

C. Credit Card (Tax Included)

Breakdown of sales made with credit cards, including tax.

Sales (Without Tip)

Total sales amount paid via credit cards, excluding tips after subtracting discounts (Net Sales + Tax – Discount).

Tips

The total tips received via credit card payments.

Total Sales

The sum of sales and tips for credit card payments.

Merchant Fee

The processing fee charged by the credit card company.

Deposit Amount

The net amount deposited after deducting merchant fees.

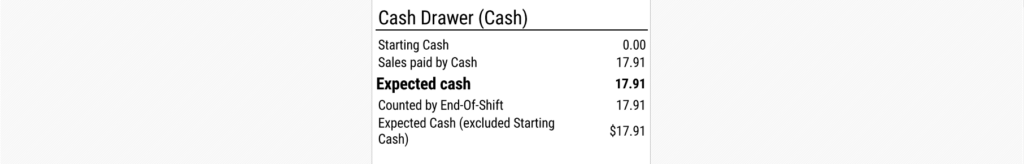

D. Cash Drawer (Cash)

Tracks the cash flow in the register during the shift.

Starting Cash

The cash amount in the drawer at the start of the shift.

Sales Paid by Cash

Total sales amount paid in cash (Net Sales + Tax – Discount).

Expected Cash

The total cash expected in the drawer at the end of the shift, including starting cash.

Counted by End-of-Shift

The actual cash counted at the end of the shift.

Expected Cash (Excluding Starting Cash)

The expected cash amount, excluding the starting cash balance.

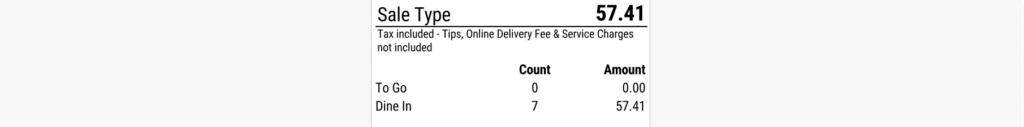

E. Sale Type

Shows sales categorized by type of service.

Tax Included – Tips, Online Delivery Fee & Service Charges Not Included

Indicates that tax is included in the sales figures, but tips, delivery fees, and service charges are excluded.

To-Go

Sales for takeout orders.

Dine-In

Sales for dine-in orders.

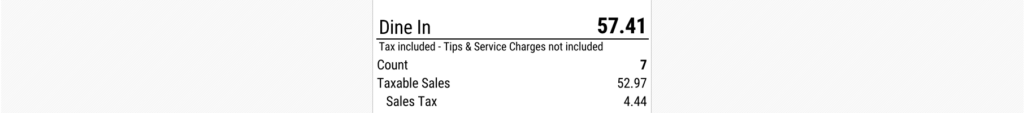

F. Dine-In

Details about dine-in sales, excluding tips and service charges.

Count

Number of dine-in orders.

Taxable Sales

Total taxable sales from dine-in orders.

Sales Tax

Total tax collected on dine-in sales.

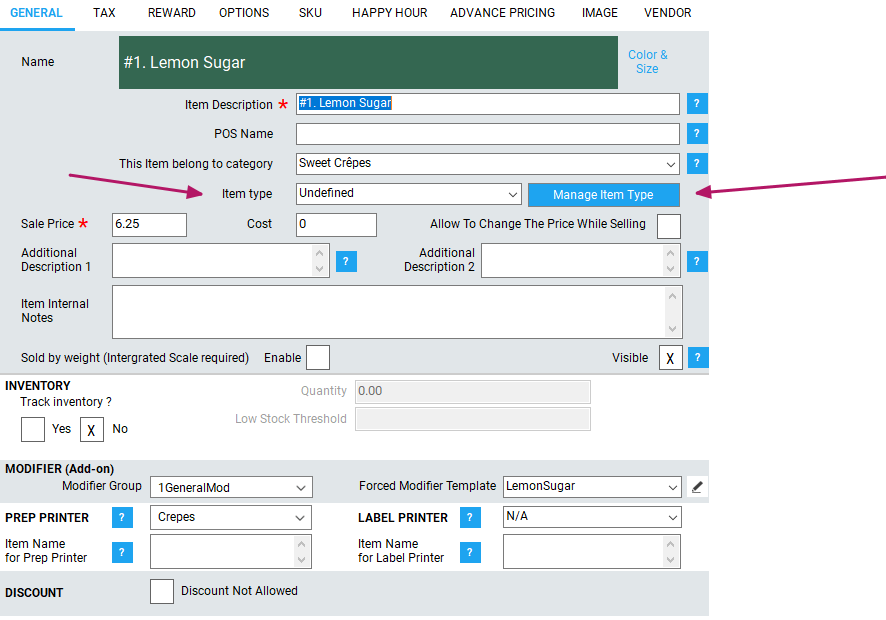

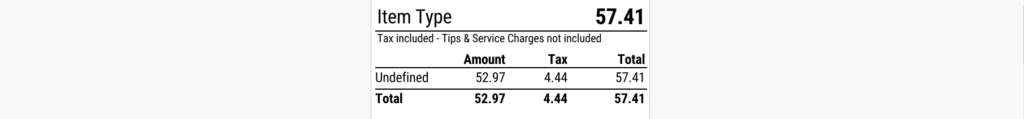

G. Item Type

Breakdown of sales by item type.

In the item type report section, it reports based on the item type defined in the product item. You can create a new item type or select an existing one.

Tax Included – Tips & Service Charges Not Included

Indicates that tax is included, but tips and service charges are excluded.

Total = Net Sales + Tax – Discount

The total sales amount, including tax, grouped by item type.

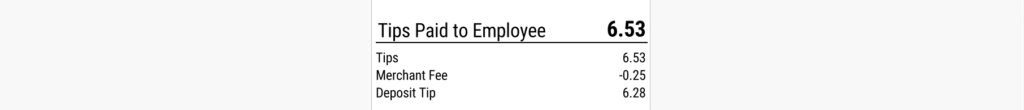

H. Tips Paid to Employee

Tracks the distribution of tips.

Tips

Total tips received during the shift.

Merchant Fee

Fees associated with tip transactions via credit card.

Deposit Tip

The net tip amount deposited after deducting merchant fees.

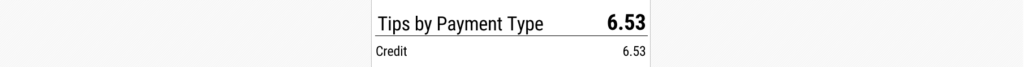

I. Tips by Payment Type

Breakdown of tips received based on payment method.

Credit

Total tips received via credit card payments.

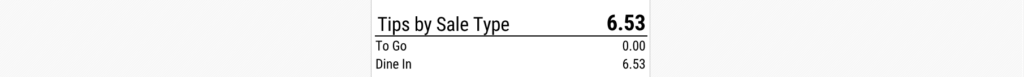

J. Tips by Sale Type

Breakdown of tips received by service type.

To-Go

Tips received for takeout orders.

Dine-In

Tips received for dine-in orders.

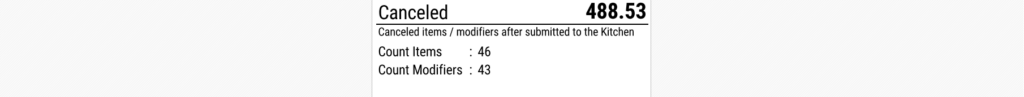

K. Canceled

Tracks items or modifiers canceled after submission to the kitchen.

Count Items

Number of items canceled.

Count Modifiers

Number of modifiers canceled.

This guide should help you understand each section of the shift report and how to use the data effectively for financial and operational tracking.